Virginia Venture Partners

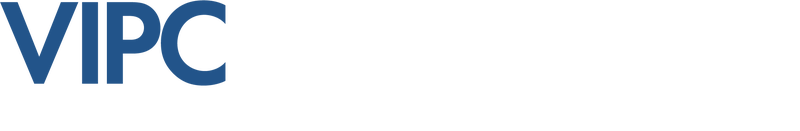

Formed in 2005, Virginia Venture Partners (VVP) places equity investment in Virginia founders and takes Limited Partner positions in venture capital funds to generate significant economic returns for entrepreneurs, General Partners (GPs), co-investors, and the Commonwealth of Virginia.

Investments for StartUps:

VVP places equity investments in Virginia’s leading technology, energy, life science and scalable non-tech startups through a family of seed and early-stage investment funds.

Fund-of-Funds Investment:

VVP Fund of Funds, invests in venture capital fund managers committed to the Commonwealth of Virginia and aligned with VVP’s seed stage investment thesis.

Virginia Venture Partners Investments in StartUps

VVP places equity investments in Virginia’s leading technology, energy, life science and scalable non-tech startups through a family of seed and early-stage investment funds capitalized by the Commonwealth of Virginia and the U.S. Treasury Department’s SSBCI Program.

VVP Direct Investment Considerations

Management Team

VVP Funds invest in founders who have a made a full-time commitment to their business, demonstrate integrity, passion, coachability and creativity, and demonstrate a record of high achievement.

Investment Stage

VVP Funds target seed and early-seed stage pre-venture investment opportunities with a clearly articulated business plan, in which Commonwealth funds serves as a critical enabler of company growth. Generally, VVP Funds invest 12-36 months in advance of a Series-A venture investment.

Investment Range

VVP Funds initially invest up to $125,000 alone, or in larger syndication rounds. Focusing use of proceeds on specific technology or business development milestones, the achievement of which will enable recipients of raise larger sums of private capital, VVP Funds seek to participate in the earliest stages of company formation.

Proprietary Advantage

VVP Funds seek portfolio companies that have a proprietary advantage such as a unique technology development approach, intellectual property position or a difficult-to-replicate business model.

Scalability

VVP Funds invest in companies capable of generating returns aligned with the expectations of angel or venture capital investors. Specifically, VVP Funds look for evidence of large-scale buying power and the company’s ability to capture, rapidly grow and sustain a dominant market position.

Geographic Focus

VVP Funds invest exclusively in companies headquartered, and with an express desire to grow in, the Commonwealth of Virginia.

Contact Us

For consideration by VVP Funds or the Virginia Founders Fund, please:

Email your executive summary or pitch deck to gap@VirginiaIPC.org

• All submissions will be reviewed in a timely manner.

• Additional questions may be addressed to the Virginia Venture Partners Team.

OR

Apply for VVP Funds using the link below

The VVP Family of Funds Includes:

A vintage 2004 fund fully invested in a diversified portfolio of seed-stage science and technology-backed companies.

Early stage funds focused on IT and technology companies.

Early stage funds focused on life science companies.

Early stage funds focused on energy efficiency and renewable energy companies.

Early stage fund focused on founder teams in Virginia’s traditionally under-served communities.

Seed stage cybersecurity fund dedicated to companies start-ups aligned with the MACH37 Accelerator.

Biotechnology | Biopharmaceuticals | Medical Devices | Laboratory Instrumentation | Diagnostics | Healthcare IT | Nutraceuticals | Agricultural | Biotechnology | Biomaterials

Software | Telecommunications | | Information & Communication Technologies | E-Commerce | Networking & Equipment | Electronics/Instrumentation | Sensors | Materials | Special Focus Areas:

Cybersecurity, Data Analytics, AI and ML, UAS

Renewable Energy | Transportation Technologies | Bio Fuels | Green Building Technologies | Water Treatment & Purification | Green Information Technology

Seed-Stage I initiative, investing in women- and minority-owned start-ups and partnering with investor networks, accelerators, and incubators that share this objective.

Seed-Stage I initiative investing in Virginia’s traditionally underserved geographies and partnering with accelerators and tech transfer programs to develop new tech start-ups.

-VVP Funds | Investments for Impact & Return-

Virginia Founders

Fund (VFF)

The Virginia Founders Fund (VFF) shines a light on the creativity and impact of entrepreneurs arising from virginia communities traditionally underserved by risk capital. Through VFF, VVP funds have committed $3M of its return for reinvestment to founders of color seeking to maximize both the economic social equity imperatives of the commonwealth.

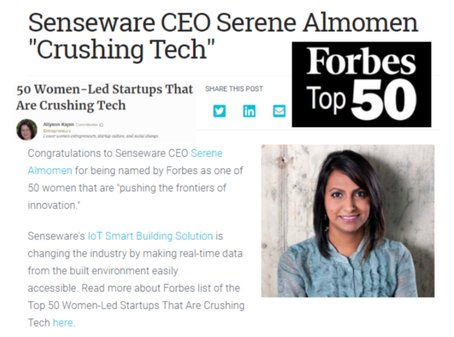

VVP Funds Named Virginia’s Most Active Investor Ranked Top 50 VC Funds Nationwide, #1 in Virginia by CBInsights

A developer of a tech market intelligence platform that analyzes millions of data points on venture capital, startups, patents, partners-hips, CB Insights named VVP Funds as “Virginia Most Active Investor” for the past five years. In this distinction, VVP Funds joins an impressive list of VCs, including California’s Andreessen Horowitz, New York’s Lerer Hippeau Ventures, and Washington D.C.’s New Enterprise Associates.

Investment Team Contacts

Tom Weithman – VIPC Chief Investment Officer and Managing Director

Mona Davis – Manager, Portfolio Analysis

Dustin Dunbar – Senior Investment Associate

Alex Euler – Senior Investment Director

Anthony Obi Jr. – Senior Investment Associate

Jennifer O’Daniel – Senior Investment Director

Marco Rubin – Senior Investment Director

Todd Hancock- Portfolio Analyst

Tate Beasley- Investment Associate

Frank Taylor- Investment Associate

Aurelia Flores- Investment Director

Investment Team Contacts

Tom Weithman – VIPC Chief Investment Officer and Managing Director

Mona Davis – Manager, Portfolio Analysis

Dustin Dunbar – Investment Associate

Alex Euler – Senior Investment Director

Anthony Obi Jr. – Investment Associate

Jennifer O’Daniel – Senior Investment Director

Marco Rubin – Senior Investment Director

Todd Hancock- Portfolio Analyst

Tate Beasley- Investment Associate

Frank Taylor- Investment Associate

Aurelia Flores- Investment Director

Investments

-Virginia Venture Partners Investment Advisory Board-

Virginia Venture Partners augments the capabilities of its core investment team by leveraging the VVP Investment Advisory Board (IAB). This independent, third-party panel consists of leading regional entrepreneurs, angel and strategic investors, and venture capital firms such as New Enterprise Associates, Grotech Ventures, Harbert Venture Partners HIG Ventures, Edison Ventures, In-Q-Tel, SJF Ventures, Cari-lion Health Systems, Johnson & Johnson, General Electric, and Alpha Natural Resources.

Professor of Practice Department of Aerospace Virginia Tech University GAP Aerospace Investment Committee

Energy Efficiency and Financing Programs Manager Virginia Department of Energy GAP Energy Fund Investment Committee

General Partner Bull City Venture Partners GAP Tech Fund Investment Committee

Director Innovation & Sustainability Technology, Dominion Energy Services, Inc. GAP Energy Fund Investment Committee

Principal D’Amico Technologies Corp (DTC) GAP Energy Fund Investment Committee

CEO Southeastern Capital Investment Holdings, LLC GAP Tech Fund Investment Committee

Managing Principal Blu Venture Investors GAP Tech Investment Committee

Special Advisor Office of Technology Transfer, NIH (National Institute of Health) GAP Life Science Fund Investment Committee

Managing Partner In-Q-Tel GAP Aerospace Investment Committee

Chief Executive Officer Angel Capital Association GAP Aerospace Investment Committee

Partner Sands Capital Ventures GAP Tech Fund Investment Committee Meeting

Chairman and Founder The Society of Physician Entrepreneurs GAP Life Science Fund Investment Committee

Technology Mentor Virginia SBDC ICAP Program GAP Aerospace Investment Committee

Executive Director Potential Energy DC GAP Energy Fund Investment Committee

Board Member VCU Commercialization Advisory Board GAP Life Science Fund Investment Committee

Managing Partner NOVI, LLC GAP Aerospace Investment Committee

Vice President Energy and Shared Resources, Connected DMV GAP Energy Fund Investment Committee

CEO Virginia Biotechnology Association GAP Life Science Fund Investment Committee

Managing Director H.I.G. BioHealth Partners GAP Life Science Fund Investment Committee

Chairman EastBanc Technologies GAP Tech Fund Investment Committee

Senior Partner In-Q-Tel GAP Tech Investment Committee

Director Cleantech to Market GAP Energy Fund Investment Committee

President and CEO Virginia Innovation Partnership Corporation GAP Tech, GAP Life Science and GAP Energy Fund Investment Committees

Principal Stratergix, LLC GAP Energy Fund Investment Committee

Partner 3TS Capital Partners GAP Tech Fund Investment Committee Meeting

Managing Member Argus Innovation, LLC GAP Life Science Fund Investment Committee

Chief Investment Officer GAP Funds GAP Tech, Life Science and GAP Energy Fund Investment Committees

Chief Executive Officer Opus8, Inc. GAP Tech Fund Investment Committee

-Investments-

A list of current and past investments in alphabetical order.

Virginia Venture Partners Plain Text List of Portfolio

Companies in Alphabetical Order:

Advanced Aircraft Company http://www.advancedaircraftcompany.com/

www.floorwire.io

https://www.roundlyx.com/

https://agrology.ag/ VIPC CRCF Award Recipient

https://4stay.com/

runsafesecurity.com/

https://418intelligence.com/ VIPC CRCF Award Recipient

https://www.rybbon.net

https://www.hellofringe.co/

SceneThink

https://www.aidahealth.com/

Givio, Inc.

https://scriyb.com/

https://aquanta.io/

https://govtribe.com/

https://scout.space/ VIPC CRCF Award Recipient

answersnow https://www.getanswersnow.com/

https://tryhungry.com/

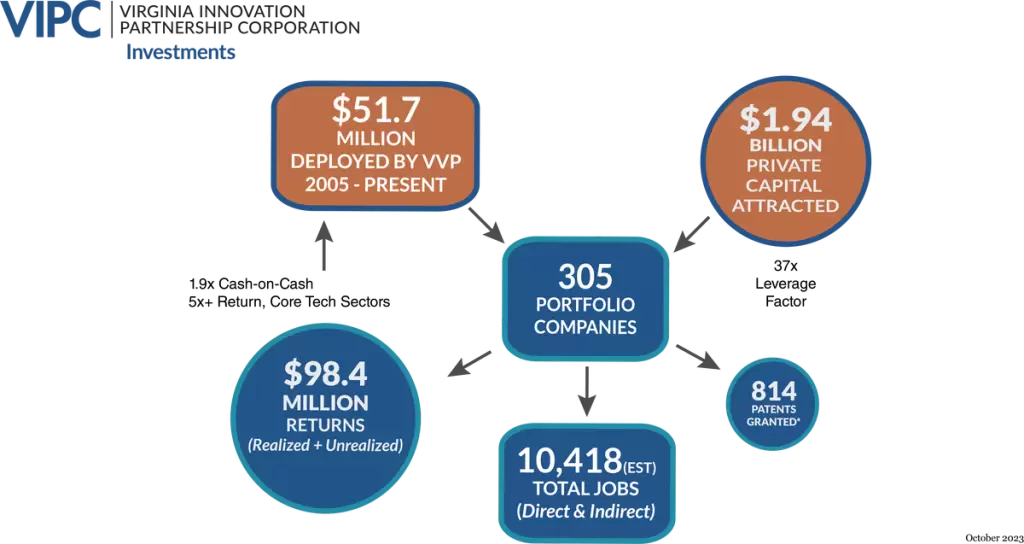

https://www.senseware.co/

https://hideez.com/

www.shevirah.com/ VIPC CRCF Award Recipient

http://arcsysonline.com/

https://hyperqube.io/

https://shiftone.com/

https://www.archemedx.com/

https://www.id.me

https://www.sitscape.com/

https://ario.com/

https://biorez.com/

www.levelfields.ai/

Synoptos (OhMyGov) https://www.ignitetech.com/synoptos/

https://www.bloompop.com/

https://www.litesheet.com/

https://tearsolutions.com/

https://www.bluetriangle.com/

https://www.livesafemobile.com

http://www.techulon.com/ VIPC CRCF Award Recipient

https://www.brazen.com/

https://loci.io/

https://tenantturner.com/

https://www.gocanvas.com/

https://www.loop88.com/

https://www.infrobotics.com/

https://slatebio.com/

https://armortext.com/

https://www.introhive.com/

https://www.skyphos.tech

https://atomicorp.com

https://jeevatrials.com/ VIPC CCF Award Recipient

https://studentopportunitycenter.com/

http://www.atworksys.com/ www.atworksys.com/ VIPC CCF Award Recipient

https://www.kamanahealth.com/

https://sunnydayfund.com/

https://www.babylonmicrofarms.com/ VIPC CRCF Award Recipient VIPC CCF Award Recipient

https://kinometrix.com/

www.sweetieboydelivers.com/